ICE MARKETS Journal

| Journal status: live ICE MARKETS joined in | not yet |

ICE MARKETS Profile

Website

Year

2015

Country

Malaysia

Branches

1

Regulation

LFSA Labuan

Registration

LFSA Labuan

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х Iran, Malaysia, North Korea, US

Broker type

STP

Dealing book

A-book

Tier

3

Execution speed

1 ms

LPs total

2

LPs quality

Other

LPs names

AT Global Markets UK , GCEX

ICE MARKETS Accounts

STP

Minimum Deposit

30 $

Leverage

300 : 1

Minimum Lot

0.01 lots

EURUSD spread

0.1 pips

Commission

5 $/lotRT

Volume

1000 lots

Margin Call

100 %

Stop Out

50 %

Execution

Market

Spread

floating

Scalping

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Skrill, Neteller, Tether, Bitcoin

Base currency

USD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 3 months

| Update broker |

- Full listing profile: ICE MARKETS broker profile

Is ICE MARKETS safe?

- Investor protection: no

- Regulation: LFSA Labuan

- Registration: LFSA Labuan

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: no

Is ICE MARKETS trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - ICE MARKETS website: highly detailed, updated

★★★★★ - ICE MARKETS popularity (by visitor count): low visits

★★

How ICE MARKETS works

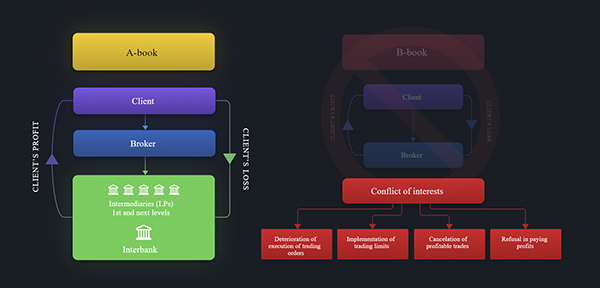

ICE Markets provides customers with liquidity, aggregated from several counterparties. This gives a number of advantages: customers always receive the best prices, they are protected against low-quality order execution by a counterparty, and are completely anonymous to him.

https://ice-markets.com/en/trading/model?tab=100abook

5.1. The Company provides investment services to the Client for the following Financial Instruments:

5.1.1. Execution of orders on behalf of the Client in respect of contracts for difference on the spot market of Forex and precious metals;

5.2. Contracts for difference that reflect trading in Financial Instruments, including exchange rates on the Forex market, do not provide for physical delivery of the underlying Financial Instrument.

https://static.ice-fx.com/files/Client%20agreement.en.pdf

4. All the Company's trading accounts are STP (Straight Through Processing) accounts and

operate on NDD (non-dealing desk) principle. This means that all trading positions are

listed on the interbank market.

5. The Company grants clients direct access to interbank liquidity, redirecting their orders to major liquidity providers. In this process, the dealing desk principle is not used, which means that there are no delays and requotes (repeated quotes) when executing the clients' orders. All transactions are executed automatically and anonymously.

6. When applying the STP scheme, the Company does not earn from clients' loss. The Company's income comes from commissions collected when trading positions are executed at a liquidity provider.

5. The Company grants clients direct access to interbank liquidity, redirecting their orders to major liquidity providers. In this process, the dealing desk principle is not used, which means that there are no delays and requotes (repeated quotes) when executing the clients' orders. All transactions are executed automatically and anonymously.

6. When applying the STP scheme, the Company does not earn from clients' loss. The Company's income comes from commissions collected when trading positions are executed at a liquidity provider.

https://static.ice-fx.com/files/STP%20reglament.en.pdf

Add new comment...