CK Markets Journal (Broker out of business)

| Journal status: closed CK Markets out of business |

CK Markets Profile

Website

ckmarkets.com

Year

2017

Country

Comoros

Branches

4

Regulation

MISA Comoros

Registration

FSA SVG

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х Afghanistan, American Samoa, Austria, Belgium, Belize, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Guam, Hungary, Indonesia, Iran, Iraq, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, North Korea, Northern Mariana Islands, Poland, Portugal, Puerto Rico, Romania, Russia, Slovakia, Slovenia, Spain, Sudan, Sweden, Syria, US, US Virgin Islands

Broker type

MM, ECN

Dealing book

A+B hybrid book, A-book

Tier

3

Execution speed

...

LPs total

7

LPs quality

Tier-1 Banks

LPs names

Barclays, Citibank, Commerzbank, Deutsche Bank, HSBC, Morgan Stanley, UBS

CK Markets Accounts

MM

ECN

Minimum Deposit

100 $

100 $

Leverage

2000 : 1

500 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1.3 pips

0 pips

Commission

0 $/lotRT

0 $/lotRT

Volume

30 lots

30 lots

Margin Call

60 %

80 %

Stop Out

30 %

50 %

Execution

Market

Market

Spread

floating

floating

Scalping

Unlimited

Unlimited

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Neteller, Tether

Base currency

USD, EUR, GBP, SGD, PLN

Segregated accounts

yes

Interest on margin

no

Inactivity fee

none

| Update broker |

Is CK Markets safe?

- Investor protection: no

- Regulation: MISA Comoros

- Registration: FSA SVG

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is CK Markets trusted?

- Information transparency: high

★★★★★ - Customer service: virtually non-existent

★ - CK Markets website: semi-detailed, updated

★★★ - CK Markets popularity (by visitor count): low visits

★★

How CK Markets works

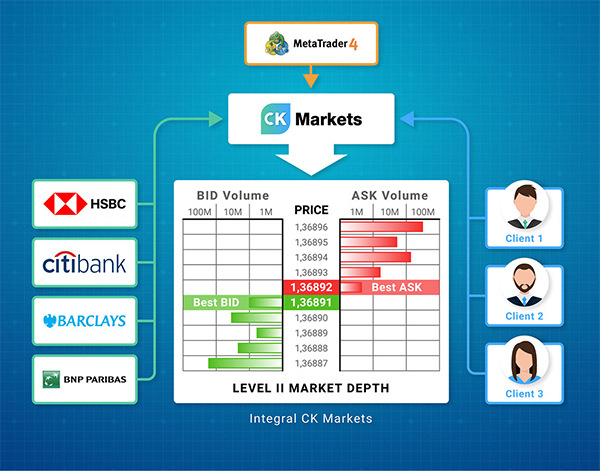

CK Markets will always act as principle when executing transactions for the clients. The Policy will apply whenever CK Markets execute transactions on behalf of professional and retail clients.

CK Markets receive price feeds from some of the world’s leading liquidity providers to ensure our clients receive the best possible price quotes. Trade orders accepted by CK Markets will be executed at the price requested by the client and at no other price, assuming there are no “slippage” and that the required price is still available.

All orders submitted by the clients to CK Markets are subjected to size consideration. The minimum size of an order is 1000 units of base currency. Although there is no maximum size for an order which can be submitted by the client, CK Markets reserves the right to decline an order if the requested size is larger than CK Markets is able to trade in the underlying market, at the requested price, at that particular point of time. Greater liquidity may be offered to the client by CK Markets at its own discretion.

The client’s orders may at the discretion of CK Markets be aggregated/split with CK Markets own orders, orders of any of CK Markets associates and/or other clients.

CK Markets allows all types of trading methods and styles.

https://ckmarkets.com/legal-documentation

Add new comment...