Forex.ee Journal

| Journal status: live Forex.ee joined in | not yet |

Forex.ee Profile

Website

Year

2004

Country

SVG

Branches

1

Regulation

not regulated

Registration

FSA SVG

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х US

Broker type

STP, ECN marketing

Dealing book

A-book

Tier

3

Execution speed

2 ms

LPs total

10

LPs quality

Tier-1 Banks, ECNs, Other

LPs names

not disclosed

Forex.ee Accounts

ECN

Minimum Deposit

15 $

Leverage

500 : 1

Minimum Lot

0.01 lots

EURUSD spread

0 pips

Commission

7 $/lotRT

Volume

Unlimited

Margin Call

100 %

Stop Out

50 %

Execution

Market

Spread

floating

Scalping

Unlimited

Deposit & Fees

Deposit methods

FasaPay, Bitcoin, Bitcoin Cash, Litecoin, Ethereum

Base currency

USD, EUR, RUB, JPY, AUD, BTC

Segregated accounts

no

Interest on margin

no

Inactivity fee

after 3 months

| Update broker |

- Full listing profile: Forex.ee broker profile

Is Forex.ee safe?

- Investor protection: no

- Regulation: not regulated

- Registration: FSA SVG

- Publicly traded: no

- Segregated account: no

- Guaranteed Stop Loss: yes

- Negative Balance Protection: no

Is Forex.ee trusted?

- Information transparency: sufficient

★★★ - Customer service: virtually non-existent

★ - Forex.ee website: highly detailed, updated

★★★★★ - Forex.ee popularity (by visitor count): low visits

★★

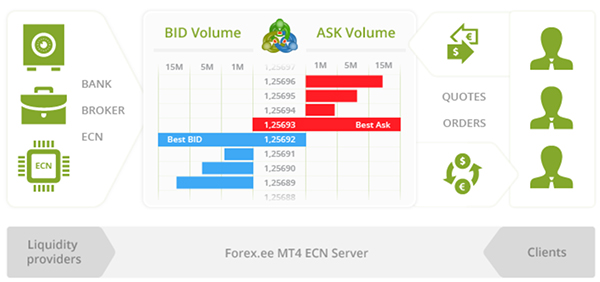

How Forex.ee works

- MetaTrader 4 ECN

- Deep liquidity

- Level2 Market depth

https://www.forexee.com/en/

- No trading restrictions (including scalping, hedging, EAs and HFT)

https://www.forexee.com/en/ecnstp/

ECN accounts

2.2.The Company executes trading orders of the Customers at the ECN/STP trading system by a technology that automatically matches buy and sell orders of incoming prices generated by all counterparties including Customers and Liquidity Providers, i.e. all Customers participate in the ECN/STP trading system as price-takers as well as price-givers.

2.5.The Company relies on its liquidity providers for the pricing which agregated and displayed via the online trading facility. 2.6.Trading operations are conducted in pursuance of "Market Execution". Execution occurs immediately at the available liquidity and market execution prices can differ from the currently displayed quote.

3.AUTHORIZATION TO TRADE

The Company is authorised to provide services in respect of FX Contracts for the Customer with a counterparty bank or financial institution, or any other person as the Company deems appropriate.

The execution of the Customer’s trading order by the Company is based on the conditions provided by a number of Counterparties involved which may apply different trading conditions, e.g. prices, commissions, overnights, leverages etc.

16. CHARGES, REMUNERATION AND COMMISSIONS

The Customer shall pay any such charges (including, without limitation, markups and markdowns..

“Liquidity Provider” – external counterparties including but not limited to banks, financial institutions, brokers, agents, clearing houses, exchanges, etc., the Company’s customers, the Cumpany and/or the Company’s affiliated legal entities.

The Customer acknowledges that market regulations and/or a significant imbalance of supply and demand, or a lack of liquidity may result in the temporary inability to buy or sell orders. This may result in the Customer holding positions for longer than desire or having to liquidate due to insufficient margin, which may result in losses up to or in excess of deposits.

2.2.The Company executes trading orders of the Customers at the ECN/STP trading system by a technology that automatically matches buy and sell orders of incoming prices generated by all counterparties including Customers and Liquidity Providers, i.e. all Customers participate in the ECN/STP trading system as price-takers as well as price-givers.

2.5.The Company relies on its liquidity providers for the pricing which agregated and displayed via the online trading facility. 2.6.Trading operations are conducted in pursuance of "Market Execution". Execution occurs immediately at the available liquidity and market execution prices can differ from the currently displayed quote.

3.AUTHORIZATION TO TRADE

The Company is authorised to provide services in respect of FX Contracts for the Customer with a counterparty bank or financial institution, or any other person as the Company deems appropriate.

The execution of the Customer’s trading order by the Company is based on the conditions provided by a number of Counterparties involved which may apply different trading conditions, e.g. prices, commissions, overnights, leverages etc.

16. CHARGES, REMUNERATION AND COMMISSIONS

The Customer shall pay any such charges (including, without limitation, markups and markdowns..

“Liquidity Provider” – external counterparties including but not limited to banks, financial institutions, brokers, agents, clearing houses, exchanges, etc., the Company’s customers, the Cumpany and/or the Company’s affiliated legal entities.

The Customer acknowledges that market regulations and/or a significant imbalance of supply and demand, or a lack of liquidity may result in the temporary inability to buy or sell orders. This may result in the Customer holding positions for longer than desire or having to liquidate due to insufficient margin, which may result in losses up to or in excess of deposits.

https://my.forex.ee/Download.aspx?name=Customer_agreement_ECN.pdf

All trades are processed directly to the market by means of ECN/STP technology without any interventions from the broker’s side.

https://www.forexee.com/en/trading/#tradingConditions

Add new comment...