⭐ ECN PRICING doesn't mean ECN DEALING

As the term "ECN pricing" gains momentum, it's important to understand the message behind it.

"ECN pricing" is just that: Pricing

It says nothing about the dealing model.

Yes, it is the best pricing (best Bid/Ask price quotes) delivered from Top-tier liquidity providers, but this is where the word "pricing" ends.

⭐ ECN pricing = ECN-style pricing ≠ ECN dealing

For many Forex traders seeing the word "ECN" triggers expectations of getting onboard of ECN trading.

In fact "ECN pricing" should be called "ECN-style pricing". This way it sets clear expectation that it is all about matching the ECN style, not being an actual ECN.

"ECN pricing" means a Broker does not make own pricing (like Market Makers do), but instead sources best price quotes from liquidity providers (LPs) and passes them to clients. High quality LPs + more LPs = best possible pricing.

"ECN pricing", however says nothing about "How the broker handles client orders", e.g. nothing about the dealing model.

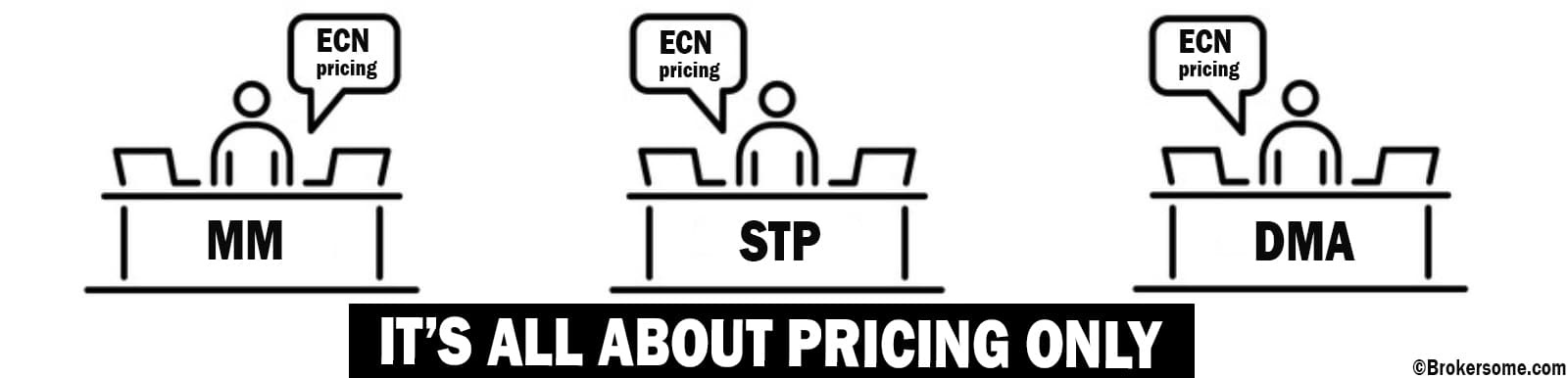

This is where many traders would be surprised to learn that a broker with "ECN pricing" could be a Market Maker or STP or DMA

ECN with ECN pricing

ECN Brokers offer true ECN pricing.

STP and DMA with "ECN pricing"

STP and DMA brokers promoting "ECN pricing" offer "ECN-style pricing"

- STP and DMA brokers with "ECN pricing" will send all orders to their LPs (A-book).

- STP and DMA brokers can choose to add mark-up to price quotes and/or charge commission.

- DMA brokers will have better LPs, and more LPs, which improves overall trading experience for clients.

Market Makers with "ECN pricing"

Marker Makers promoting "ECN pricing" offer "ECN-style pricing"

Such Market Makers would be Hybrid = A+B-book dealing type, where A-booked orders are passed to LPs (No Dealing Desk model), while B-booked orders are held in-house and processed internally, e.g. countertraded by the broker (Dealing Desk model).

Conclusion

As we can see, it is "Business as usual" for all Forex brokers.

Just that little fancy word "ECN" mentioned by a Broker tends to receive more attention from traders, and thus higher client conversion for the Broker.

It's a pure marketing power in action!

Copyright © Brokersome!

Read next...

Add new comment...