ICE FX Journal (Broker rebranded)

| Journal status: closed ICE FX rebranded |

| Update broker |

- Full listing profile: ICE FX broker profile

Is ICE FX safe?

- Investor protection: no

- Regulation: FSA Labuan

- Registration: FSA Labuan

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: no

Is ICE FX trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - ICE FX website: highly detailed, updated

★★★★★ - ICE FX popularity (by visitor count): low visits

★★

How ICE FX works

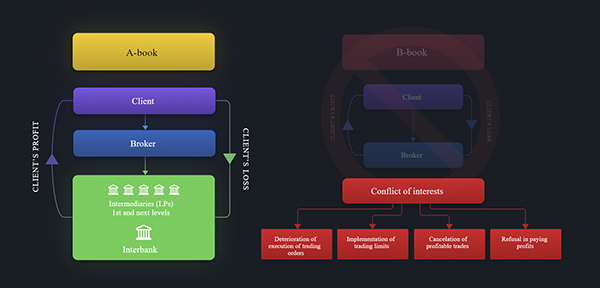

ICE FX works exclusively under the A book model, which means that ALL trades are executed at external counterparties (liquidity providers). This eliminates any possible conflict of interest between the customer and the broker.

ICE FX hedging 100% client positions with external counterparties. Any client can request for online demonstration of the orders executed by them with counterparties in the company's back office.

5.1. The Company provides investment services to the Client for the following Financial Instruments:

5.1.1. Execution of orders on behalf of the Client in respect of contracts for difference on the spot market of Forex and precious metals;

4. All the Company's trading accounts are STP (Straight Through Processing) accounts and operate on NDD (non-dealing desk) principle. This means that all trading positions are listed on the interbank market.

5. The Company grants clients direct access to interbank liquidity, redirecting their orders to major liquidity providers. In this process, the dealing desk principle is not used, which means that there are no delays and requotes (repeated quotes) when executing the clients' orders. All transactions are executed automatically and anonymously.

6. When applying the STP scheme, the Company does not earn from clients' loss. The Company's income comes from commissions collected when trading positions are executed at a liquidity provider.

Add new comment...