CM Index Journal (Broker out of business)

| Journal status: closed CM Index out of business |

CM Index Profile

Website

cmindex.com

Year

2021

Country

SVG

Branches

1

Regulation

not regulated

Registration

FSA SVG

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х Algeria, Argentina, Armenia, Austria, Azerbaijan, Bahrain, Belarus, Belgium, Belize, Bolivia, Brazil, Bulgaria, Canada, Chile, Colombia, Comoros, Costa Rica, Croatia, Cuba, Cyprus, Czechia, Denmark, Djibouti, Dominican Republic, Ecuador, Egypt, El Salvador, Estonia, Finland, France, French Guiana, Georgia, Germany, Greece, Guatemala, Guyana, Haiti, Honduras, Hungary, Iraq, Ireland, Italy, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Latvia, Lebanon, Libya, Lithuania, Luxembourg, Malta, Mauritania, Mexico, Moldova, Morocco, Netherlands, Nicaragua, Oman, Palestine, Panama, Paraguay, Peru, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Slovakia, Slovenia, Somalia, South America, Spain, Sudan, Suriname, Sweden, Syria, Tajikistan, Tunisia, Turkmenistan, UAE, US, Ukraine, Uruguay, Uzbekistan, Venezuela, Yemen

Broker type

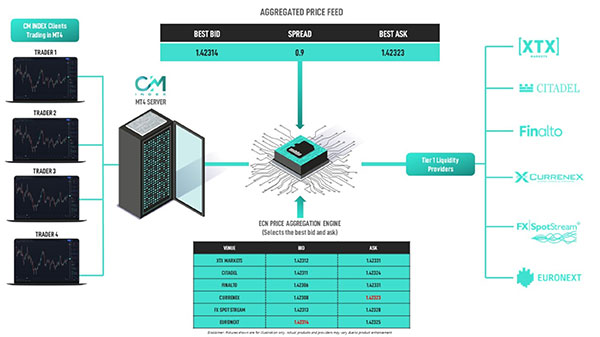

STP, DMA, ECN pricing

Dealing book

A-book

Tier

3

Execution speed

3 ms

LPs total

30

LPs quality

Tier-1 Banks, ECNs, Non-Banks

LPs names

BNP Paribas, Barclays, Citadel Securities, Credit Suisse, Currenex, Euronext, FX SpotStream, Finalto, Goldman Sachs, JPMorgan, UBS, XTX Markets

CM Index Accounts

STP

ECN

Minimum Deposit

15 $

100 $

Leverage

8888 : 1

200 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1 pips

0.1 pips

Commission

0 $/lotRT

7 $/lotRT

Volume

100 lots

100 lots

Margin Call

50 %

50 %

Stop Out

30 %

30 %

Execution

Market

Market

Spread

floating

floating

Scalping

yes

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Local Transfer, Skrill, Neteller, Tether, Bitcoin, Ethereum, Binance Coin

Base currency

USD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 6 months

| Update broker |

Is CM Index safe?

- Investor protection: no

- Regulation: not regulated

- Registration: FSA SVG

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is CM Index trusted?

- Information transparency: high

★★★★★ - Customer service: virtually non-existent

★ - CM Index website: highly detailed, updated

★★★★★ - CM Index popularity (by visitor count): average

★★★

How CM Index works

3.1 The Company is the Execution Venue for the execution of Clients’ Orders in CFDs. So, about Client CFD transactions, the Company executes the Client Orders.

Company’s price: The Company’s price for a given Financial Instrument is provided from the Liquidity Provider with spread markup and/or commission charges.

https://cmindex.com/wp-content/uploads/2023/01/6.-Order-Execution-Policy-CM-Index.pdf

9.3. The Client will, unless otherwise agreed in writing, understands and acknowledges that the Company will enter into transactions with the client as

Principal (counterparty) and also as an Agency(intermediary). The Company will be the contractual counterparty & intermediary to the Client.

26.1. The Client is not allowed to enter into any form of prohibited trading i.e. certain trading techniques commonly known as "arbitrage trading", "picking/ sniping" or the use of certain automated trading systems or “Expert Advisors”;

16.4. In the event that a negative balance occurs in the Client’s Trading Account due to Stop Out, the Company will make a relevant adjustment of

the full negative amount so as to the Client not to suffer the loss.

https://cmindex.com/wp-content/uploads/2023/01/1.-Account-Opening-Agreement-CM-Index.pdf

https://cmindex.com/execution-technology/

Comments

Add new comment...