ICM Capital Journal

| Journal status: live ICM Capital joined in | not yet |

ICM Capital Profile

Website

Year

2011

Country

UK

Branches

2

Regulation

FCA UK

Registration

FCA UK

Investor protection

Fund protection

UK Financial Services Compensation Scheme (FSCS), Civil Liability Insurance Programme

Publicly traded

no

Restricted in

Not serving

х US

Broker type

MM, DMA, ECN pricing

Dealing book

A+B hybrid book, A-book

Tier

3

Execution speed

13 ms

LPs total

1

LPs quality

Other

LPs names

ICM Capital

ICM Capital Accounts

MM

ECN

Minimum Deposit

200 $

200 $

Leverage

200 : 1

200 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1.3 pips

0 pips

Commission

0 $/lotRT

7 $/lotRT

Volume

500 lots

500 lots

Margin Call

100 %

100 %

Stop Out

50 %

50 %

Execution

Market

Market

Spread

floating

floating

Scalping

no

no

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Skrill, Neteller

Base currency

USD, EUR, GBP, SGD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

none

| Update broker |

- Full listing profile: ICM Capital broker profile

Is ICM Capital safe?

- Investor protection: UK Financial Services Compensation Scheme (FSCS), Civil Liability Insurance Programme

- Regulation: FCA UK

- Registration: FCA UK

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is ICM Capital trusted?

- Information transparency: high

★★★★★ - Customer service: not so helpful

★★ - ICM Capital website: highly detailed, updated

★★★★★ - ICM Capital popularity (by visitor count): low visits

★★

How ICM Capital works

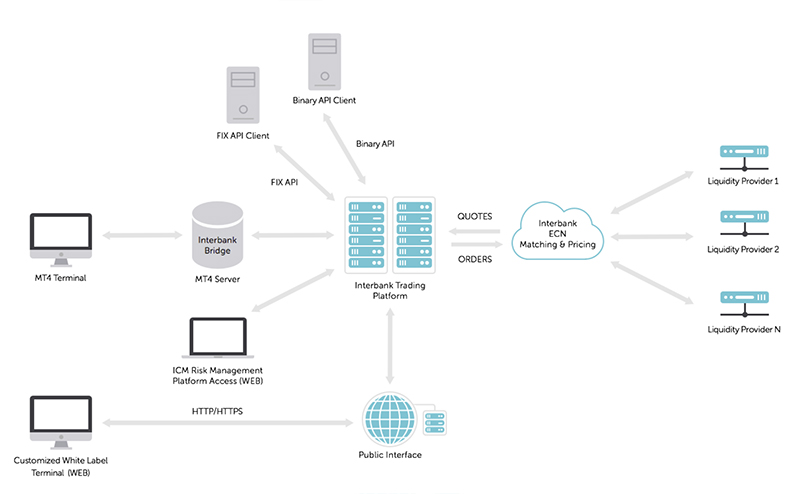

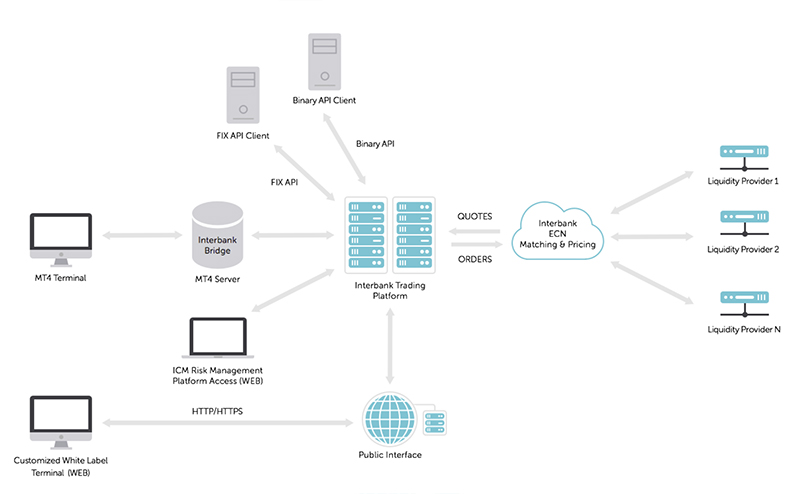

8. Trading Models

ICM currently operates a hybrid model which consists of a No Dealing Desk, and a Dealing Desk acting as the market maker. To ensure that ICM is meeting its best execution obligations at all times, it will at its own discretion make decisions to either pass on to its clients the best spread prices provided by its liquidity providers (No Dealing Desk), or act as the market maker (Dealing Desk) by entering into the trade directly with the client and make its own prices.

Every market quoted by ICM Capital is derived directly from an underlying financial instrument sourced from an exchange or from a wholesale quoting counterparty (i.e. FX quoting banks). ICM Capital determines which markets to quote, the times at which those markets are quoted; ICM Capital publishes via its trading platforms those quotes (we show the aggregated price between our Liquidity Provider) at a tight spread or with a mark-up on which clients may be able to trade.

https://www.icmcapital.co.uk/static/media/1305364/order-of-execution-policy-en.pdf

ICM Direct - Institutional Trading Platform

ICM Capital uses an in-house tool called 'Electronic Communication Network (ECN)' which is an automated system that matches buy and sell orders, taking into account the best possible prices and the speed of the execution. The ECN allows ICM Capital to ensure that, when executing orders, that it is achieving the best possible outcome for its clients.

ICM Capital uses an in-house tool called 'Electronic Communication Network (ECN)' which is an automated system that matches buy and sell orders, taking into account the best possible prices and the speed of the execution. The ECN allows ICM Capital to ensure that, when executing orders, that it is achieving the best possible outcome for its clients.

https://www.icmcapital.co.uk/static/media/1586206/rts28-2018-en.pdf

All Quotes are based upon an Underlying Market that is sourced from

either a recognised global exchange (LSE, NYSE, LIFFE etc) or from a wholesale counterparty (a

quoting bank or market maker).

5.12 In cases of any indiscretion in trading, overleveraging, misuse of orders where "scalping" or “sniping” or “hedging” or “arbitraging” may be involved, such transactions will not be taken into consideration and will be treated as prohibited activity and may even be removed from participants accounts.

5.12 In cases of any indiscretion in trading, overleveraging, misuse of orders where "scalping" or “sniping” or “hedging” or “arbitraging” may be involved, such transactions will not be taken into consideration and will be treated as prohibited activity and may even be removed from participants accounts.

https://www.icmcapital.co.uk/static/media/1305686/icm-client-agreement-1.pdf

Add new comment...