IFC Markets Journal

| Journal status: live IFC Markets joined in | not yet |

IFC Markets Profile

Website

Year

2006

Country

BVI

Branches

4

Regulation

FSC BVI

Registration

FSC BVI

Investor protection

Fund protection

Cyprus Investor Compensation Fund (ICF)

Publicly traded

no

Restricted in

Not serving

х BVI, Russia, US

Broker type

MM, STP, ECN marketing

Dealing book

A+B hybrid book, A-book

Tier

3

Execution speed

...

LPs total

...

LPs quality

not disclosed

LPs names

not disclosed

IFC Markets Accounts

MM

STP

ECN

Minimum Deposit

1000 $

1000 $

1000 $

Leverage

200 : 1

200 : 1

200 : 1

Minimum Lot

0.1 lots

0.1 lots

0.1 lots

EURUSD spread

1.8 pips

0.4 pips

0 pips

Commission

0 $/lotRT

0 $/lotRT

10 $/lotRT

Volume

10000 lots

10000 lots

10000 lots

Margin Call

10 %

10 %

10 %

Stop Out

10 %

10 %

10 %

Execution

Instant

Market

Market

Spread

fixed

floating

floating

Scalping

yes

yes

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Perfect Money, WebMoney, Bitwallet, TCPAY, IRPAY, M-PESA, Bitcoin

Base currency

USD, EUR, JPY, BTC

Segregated accounts

yes

Interest on margin

yes

Inactivity fee

none

| Update broker |

- Full listing profile: IFC Markets broker profile

Is IFC Markets safe?

- Investor protection: Cyprus Investor Compensation Fund (ICF)

- Regulation: FSC BVI

- Registration: FSC BVI

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is IFC Markets trusted?

- Information transparency: sufficient

★★★ - Customer service: not so helpful

★★ - IFC Markets website: highly detailed, updated

★★★★★ - IFC Markets popularity (by visitor count): average

★★★

How IFC Markets works

What type of broker is IFC Markets?

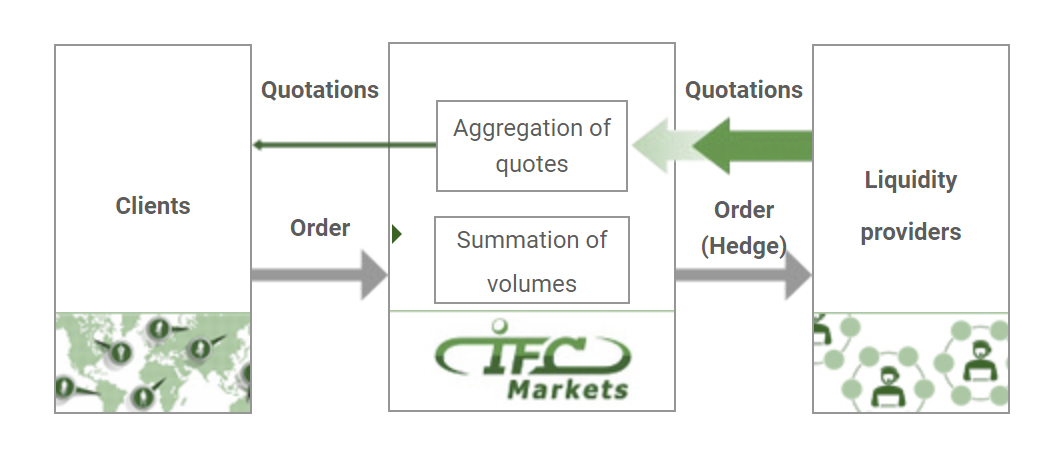

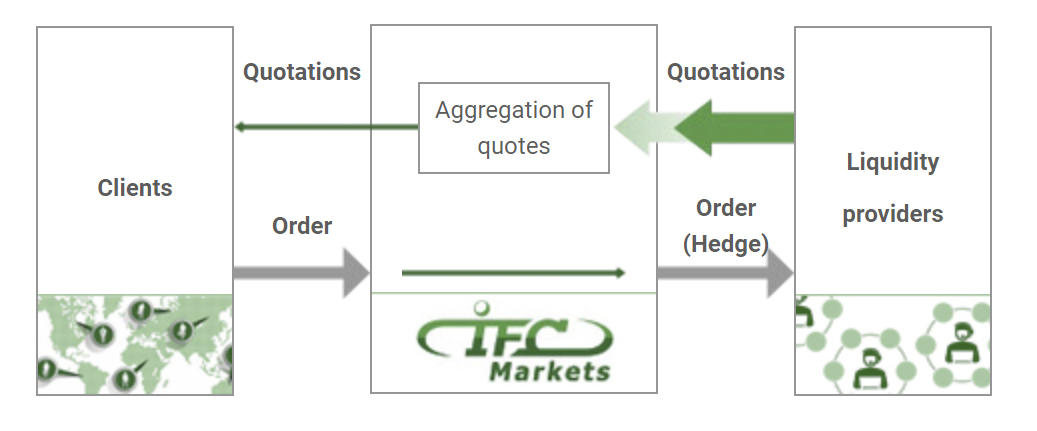

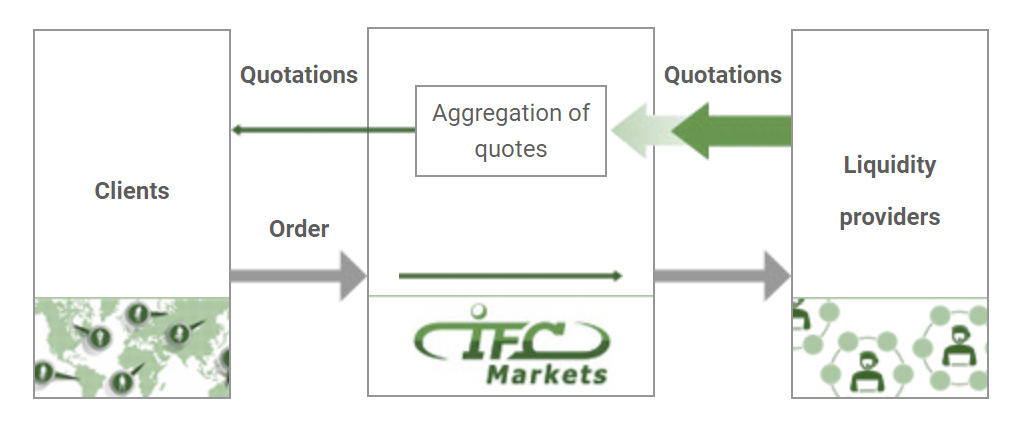

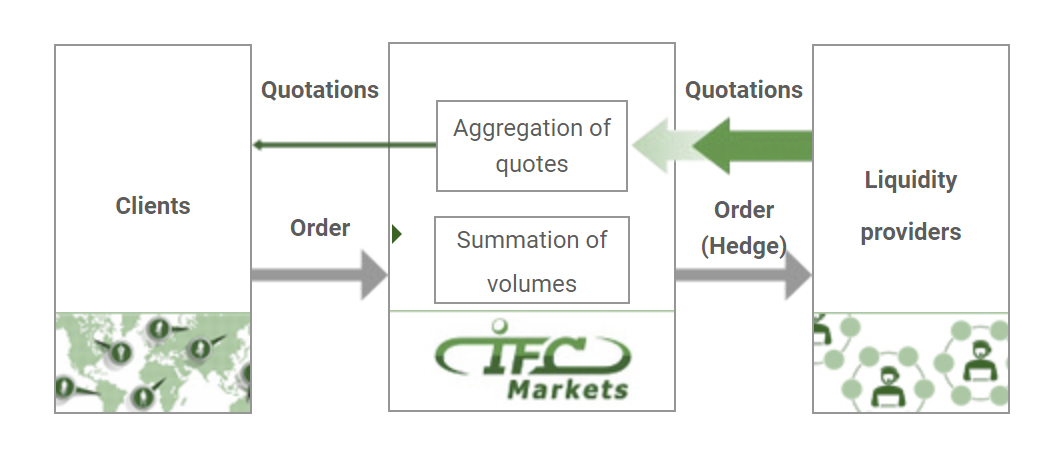

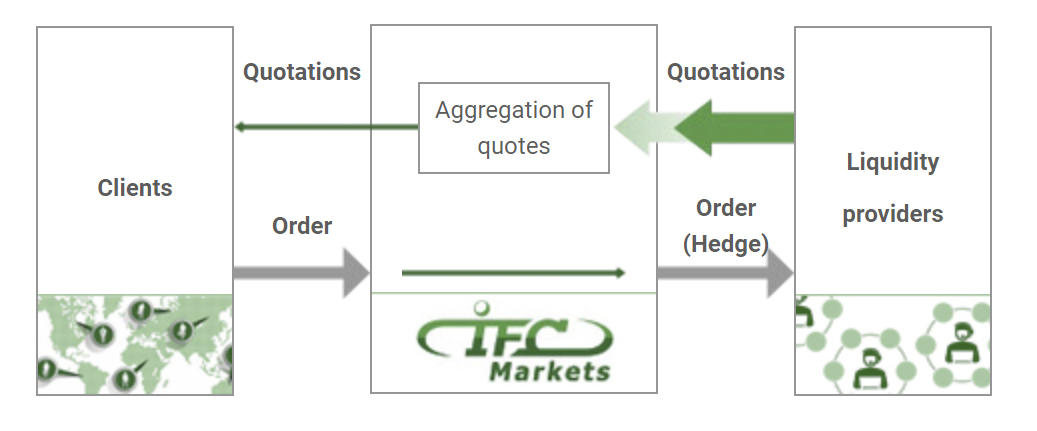

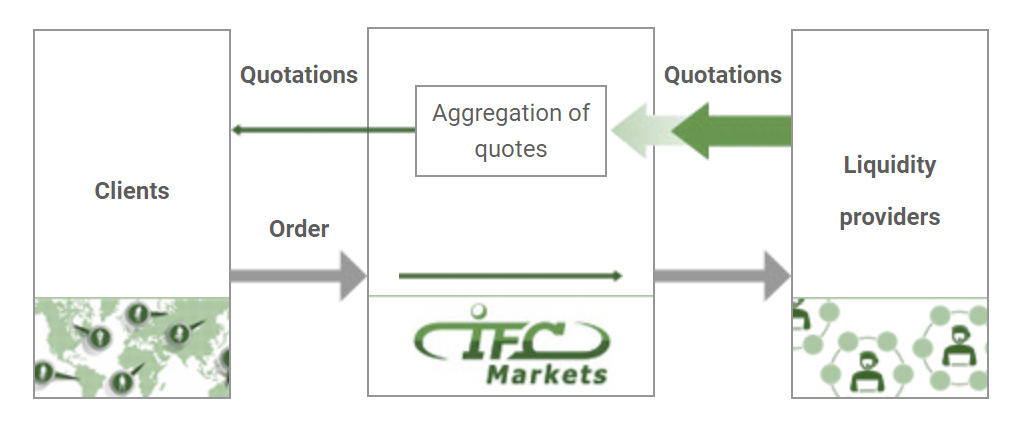

IFC Markets is an STP broker (Straight-through processing - automatic realization of transactions with financial instruments). This means that we receive quotations from our liquidity providers, and accumulated clients’ orders are transferred to the marketplaces, accordingly.

https://www.ifcmarkets.com/en/faqs#broker-type_309

IFC Markets performs the trade execution process on a hybrid basis depending on the clients' orders volumes.

a) Small-volume order execution (up to $1 million)

The orders are executed instantly at the quote of the company’s trading terminal, then are summed into the bigger ones and only after that are hedged through the liquidity provider.

b) Medium-volume order execution (from $1 - $10 million)

The order is executed instantly at the quote of the company’s trading terminal and is automatically hedged immediately by our liquidity provider. That is the STP (straight through processing) model of trade execution.

c) Large-volume order execution (over $10 million)

The order goes to the company's server and is immediately received by the liquidity provider, which confirms the possibility of executing the transaction (if the price remained unchanged) and the transaction is executed.

The Business-model of the Company is based on transparent and trustworthy relations with the client. The Company receives quotations from leading banks-liquidity providers in the ECN marketplaces and forms streaming quotations for clients from the best prices. In the trading terminal the client sees and trades with the best bid and ask prices on each financial instrument. As a result clients' orders are performed at the price of the liquidity provider that currently offers the best Buy or Sell prices. Our Prime Broker performs clearing functions (settlement of mutual liabilities) between the Company and Banks – liquidity providers.

a) Small-volume order execution (up to $1 million)

The orders are executed instantly at the quote of the company’s trading terminal, then are summed into the bigger ones and only after that are hedged through the liquidity provider.

b) Medium-volume order execution (from $1 - $10 million)

The order is executed instantly at the quote of the company’s trading terminal and is automatically hedged immediately by our liquidity provider. That is the STP (straight through processing) model of trade execution.

c) Large-volume order execution (over $10 million)

The order goes to the company's server and is immediately received by the liquidity provider, which confirms the possibility of executing the transaction (if the price remained unchanged) and the transaction is executed.

The Business-model of the Company is based on transparent and trustworthy relations with the client. The Company receives quotations from leading banks-liquidity providers in the ECN marketplaces and forms streaming quotations for clients from the best prices. In the trading terminal the client sees and trades with the best bid and ask prices on each financial instrument. As a result clients' orders are performed at the price of the liquidity provider that currently offers the best Buy or Sell prices. Our Prime Broker performs clearing functions (settlement of mutual liabilities) between the Company and Banks – liquidity providers.

https://www.ifcmarkets.com/en/business-model

5. Trading on ECN Accounts

Clients can trade (various financial instruments) on the ECN (Electronic Communication Network) trading platform, which offers the following additional benefits: Even tighter spreads (close to 0)....

https://www.ifcmarkets.com/en/best-trade-execution

(57) ...being a Market Maker, we are the customer’s immediate counterpart in relation to any Transaction entered into by a customer via our

Online Trading Facility;

64. MARKET MAKING

64.1 You are specifically made aware that in certain markets, including the foreign exchange markets, OTC foreign exchange options and CFD Contracts, we may act as a “Market Maker”

64.3 Following execution of any position with you, we may, at our reasonable discretion, subsequently offset each such position with you with another customer position or with a position with one of our counterparties, or we may decide to retain a proprietary position in the Market with the intention to obtain trading profits from such positions.

64. MARKET MAKING

64.1 You are specifically made aware that in certain markets, including the foreign exchange markets, OTC foreign exchange options and CFD Contracts, we may act as a “Market Maker”

64.3 Following execution of any position with you, we may, at our reasonable discretion, subsequently offset each such position with you with another customer position or with a position with one of our counterparties, or we may decide to retain a proprietary position in the Market with the intention to obtain trading profits from such positions.

https://www.ifcmarkets.com/pdf_files/Customer_Agreement.pdf

Add new comment...