NPBFX Journal

| Journal status: live NPBFX joined in | not yet |

NPBFX Profile

Website

Year

1996

Country

Comoros

Branches

1

Regulation

not regulated

Registration

Financialcommission.org

Investor protection

Fund protection

Financialcommission.org

Publicly traded

no

Restricted in

Not serving

х Canada, US

Broker type

STP

Dealing book

A-book

Tier

3

Execution speed

14 ms

LPs total

12

LPs quality

Tier-1 Banks, ECNs

LPs names

BNP Paribas, Bank of America, Barclays, Citibank, Currenex, Deutsche Bank, Goldman Sachs, HSBC, Hotspot, Integral, JPMorgan, RBS

NPBFX Accounts

STP

Minimum Deposit

10 $

Leverage

1000 : 1

Minimum Lot

0.01 lots

EURUSD spread

0.8 pips

Commission

0 $/lotRT

Volume

Unlimited

Margin Call

20 %

Stop Out

30 %

Execution

Market

Spread

floating

Scalping

Unlimited

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, WebMoney, QIWI, Yandex.Money, FasaPay, Skrill, Neteller, NganLuong, Payoma, Local Transfer Thailand, Local Transfer Vietnam, Local Transfer Malaysia, Local Transfer Indonesia

Base currency

USD, EUR, RUB

Segregated accounts

yes

Interest on margin

no

Inactivity fee

none

| Update broker |

- Full listing profile: NPBFX broker profile

Is NPBFX safe?

- Investor protection: Financialcommission.org

- Regulation: not regulated

- Registration: Financialcommission.org

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is NPBFX trusted?

- Information transparency: high

★★★★★ - Customer service: prompt, helpful

★★★★★ - NPBFX website: highly detailed, updated

★★★★★ - NPBFX popularity (by visitor count): average

★★★

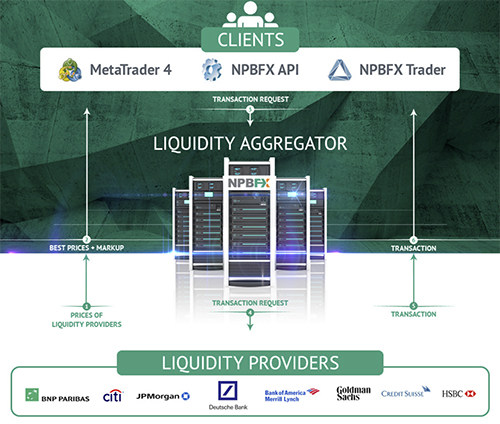

How NPBFX works

Direct output to the interbank opened market.

The NPBFX company serving customers in the Forex market only by broker model: every customer’s transaction outputs to liquidity providers (interbank foreign exchange market). Output to the interbank foreign exchange market carried out automatically by STP/NDD technology (Straight-Through Processing /Non Dealing Desk).

Each customer transaction is hedged with liquidity provider, so the company does not appear open currency position. Customer service income mainly comes from a supplement to the spreads — markup and / or the commission. The broker model eliminates the ficancial conflict of interest between the company and the client, because the company earns only from the client`s trading turnover.

https://www.npbfx.com/en/trading/stp_technology/

Scalping and high-frequency trading (HFT): Allowed and welcomed

https://www.npbfx.com/en/trading/account_types/

Add new comment...