Samtrade FX Journal

| Journal status: live Samtrade FX joined in | not yet |

Samtrade FX Profile

Website

Year

2019

Country

SVG

Branches

8

Regulation

not regulated

Registration

FSA SVG, FINTRAC Canada, Financialcommission.org

Investor protection

Fund protection

Financialcommission.org, Falcon Insurance

Publicly traded

OTC:SMFX

Restricted in

Not serving

х Afghanistan, Africa, Belarus, Brazil, Burundi, Colombia, Cuba, Egypt, Iran, Iraq, Japan, Nicaragua, North Korea, Pakistan, Spain, Sudan, Syria, Togo, US, Ukraine, Venezuela, Yemen, Zimbabwe

Broker type

STP, ECN pricing

Dealing book

A-book

Tier

3

Execution speed

...

LPs total

5

LPs quality

Tier-1 Banks

LPs names

Barclays, Credit Suisse, Goldman Sachs, JPMorgan, UBS

Samtrade FX Accounts

STP

ECN

Minimum Deposit

10 $

100 $

Leverage

1000 : 1

200 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

1.7 pips

1.7 pips

Commission

0 $/lotRT

0 $/lotRT

Volume

100 lots

100 lots

Margin Call

100 %

100 %

Stop Out

50 %

50 %

Execution

Market

Market

Spread

floating

floating

Scalping

no

no

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Tether

Base currency

USD

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 3 months

| Update broker |

- Full listing profile: Samtrade FX broker profile

Is Samtrade FX safe?

- Investor protection: Financialcommission.org, Falcon Insurance

- Regulation: not regulated

- Registration: FSA SVG, FINTRAC Canada, Financialcommission.org

- Publicly traded: OTC:SMFX

- Segregated account: yes

- Guaranteed Stop Loss: no

- Negative Balance Protection: yes

Is Samtrade FX trusted?

- Information transparency: limited

★★ - Customer service: virtually non-existent

★ - Samtrade FX website: highly detailed, updated

★★★★★ - Samtrade FX popularity (by visitor count): average

★★★

How Samtrade FX works

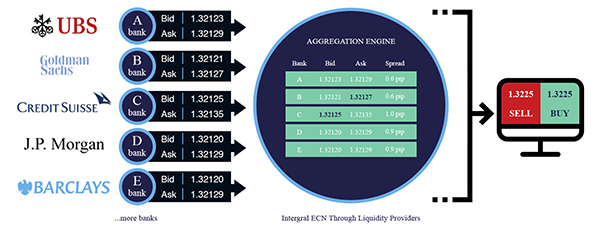

At Samtrade FX there's never a conflict of interest between us and our clients. As a STP/ECN brokerage, clients trades are passed on straight to our liquidity providers; we make only a marginal profit on commissions, which stems from traded volume.

The STP/ECN model is favored by many traders, as firms operating in the STP/ECN model are often able to offer more competitive spreads. STP/ECN brokerages pass many trades on to the liquidity providers who are able to offer very tight spreads due to the huge volumes they are dealing in, meaning under standard market conditions spreads tend to be much tighter.

https://www.samtradefx.com/business-model

Add new comment...