Abshire-Smith Journal (Broker out of business)

| Journal status: closed Abshire-Smith out of business |

Abshire-Smith Profile

Website

www.abshire-smith.com

Year

2011

Country

UK

Branches

1

Regulation

none

Registration

none

Investor protection

Fund protection

no

Publicly traded

no

Restricted in

Not serving

х Iran, US

Broker type

DMA

Dealing book

A-book

Tier

3

Execution speed

...

LPs total

0

LPs quality

not disclosed

LPs names

not disclosed

Abshire-Smith Accounts

DMA

Minimum Deposit

500 $

Leverage

100 : 1

Minimum Lot

0.01 lots

EURUSD spread

0.7 pips

Commission

18 $/lotRT

Volume

...

Margin Call

...

Stop Out

...

Execution

Market

Spread

floating

Scalping

yes

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card, Skrill, Neteller, CASHU

Base currency

USD, AUD, GBP, EUR, JPY

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after ... months

| Update broker |

Is Abshire-Smith safe?

- Investor protection: no

- Regulation: none

- Registration: none

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: ...

- Negative Balance Protection: no

Is Abshire-Smith trusted?

- Information transparency: high

★★★★★ - Customer service: virtually non-existent

★ - Abshire-Smith website: semi-detailed, updated

★★★ - Abshire-Smith popularity (by visitor count): low visits

★★

How Abshire-Smith works

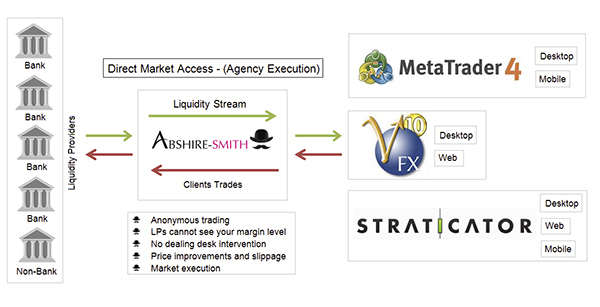

Abshire-Smith can provide direct market access (DMA) for Forex FX, CFDs and equities. We leverage our relationships to provide access to tier 1 liquidity and aggregation venues (ECNs).

The no dealing desk (NDD) agency execution removes the conflict of interest between the broker and the client. Our DMA offering is open for all clients.

Raw spread + commission trading accounts

Liquidity sourced from tier 1 banks, proprietary trading desks and ECNs

Scalping, high frequency and news trading accepted

https://www.abshire-smith.com/direct-market-access-dma/

ABS may execute trades through a variety of Banks, Prime Brokers, Hedge Funds, Market Makers or other clearing houses.

Please note that ABS does not trade outside of a regulated market or Multilateral Trading Facility (MTF) or deal in any OTC transaction in the EEA.

Part two: Order Execution Policy We have set out below the criteria which determines how we select the different venues on which we may execute your order and have identified those venues (which may include your dealings with us on a principal-to-principal basis) on which we will most regularly seek to execute your orders and which we believe offer the best prospects for affording you best execution.

ABS does not trade as principal.

Order aggregation will seldom occur, because of the nature of our business. When it does occur, orders will be allocated in a fair way, i.e. at a weighted average price. Allocation on partial fills will also be made on a weighted average basis. Client orders will not be aggregated with those of the firm, as the firm does not deal on a proprietary basis.

Please note that ABS does not trade outside of a regulated market or Multilateral Trading Facility (MTF) or deal in any OTC transaction in the EEA.

Part two: Order Execution Policy We have set out below the criteria which determines how we select the different venues on which we may execute your order and have identified those venues (which may include your dealings with us on a principal-to-principal basis) on which we will most regularly seek to execute your orders and which we believe offer the best prospects for affording you best execution.

ABS does not trade as principal.

Order aggregation will seldom occur, because of the nature of our business. When it does occur, orders will be allocated in a fair way, i.e. at a weighted average price. Allocation on partial fills will also be made on a weighted average basis. Client orders will not be aggregated with those of the firm, as the firm does not deal on a proprietary basis.

http://www.abshire-smith.com/best-execution/

We will execute your orders in accordance with the Best Execution Policy which will be provided to you separately. We may hedge such trades either through OTC contracts or Exchange traded contracts. In all cases, those contracts will be traded against their market counterparties who in turn may trade directly against the Exchange(s).

The main Exchanges from which such prices may be quoted are: CBOT, CME, COMMEX, EUREX, EURONEXT, HFE, LIFFE, ICE, MIL, MFM, MSE, NYMEX, NYBOT, NYSE, OML, OBX, OSE, SFE & NASDAQ OMX

The main Exchanges from which such prices may be quoted are: CBOT, CME, COMMEX, EUREX, EURONEXT, HFE, LIFFE, ICE, MIL, MFM, MSE, NYMEX, NYBOT, NYSE, OML, OBX, OSE, SFE & NASDAQ OMX

https://www.abshire-smith.com/client-agreement/

Emails never replied and/or periodically return "Email Undeliverable" error.

Regulatory License: None (FCA authorization revoked Feb 2021)

Company Status: Dissolved (as of May 20, 2025)

In 2026 the website still remains online and active, yet it does not appear possible to open a Live trading account.

Comments

Add new comment...