FXOpen UK Journal

| Journal status: live FXOpen UK joined in | not yet |

FXOpen UK Profile

Website

Year

2005

Country

UK

Branches

1

Regulation

FCA UK

Registration

FCA UK

Investor protection

Fund protection

UK Financial Services Compensation Scheme (FSCS)

Publicly traded

no

Restricted in

Not serving

х Belgium, Czechia, US

Broker type

STP, ECN-style pricing

Dealing book

A-book

Execution model

NDD

Tier

3

Execution speed

1 ms

LPs total

15

LPs quality

Tier-1 Banks, Tier-2 PoPs, ECNs, other

LPs names

Bank of America, Barclays, CRNX, Citibank, Deutsche Bank, Dresdner, Goldman Sachs, Hotspot, JPMorgan, LavaFX, Morgan Stanley, RBS, SG Paris, Standard Chartered, UBS

FXOpen UK Accounts

STP

ECN

Minimum Deposit

300 $

1000 $

Leverage

30 : 1

30 : 1

Minimum Lot

0.01 lots

0.01 lots

EURUSD spread

0 pips

0 pips

Commission

7 $/lotRT

5 $/lotRT

Volume

Unlimited

Unlimited

Margin Call

100 %

100 %

Stop Out

50 %

50 %

Execution

Market

Market

Spread

floating

floating

Scalping

Unlimited

Unlimited

Deposit & Fees

Deposit methods

Bank Wire, Credit Card, Debit Card

Base currency

USD, EUR, GBP

Segregated accounts

yes

Interest on margin

no

Inactivity fee

after 6 months

| Update broker |

- Full listing profile: FXOpen UK broker profile

Is FXOpen UK safe?

- Investor protection: UK Financial Services Compensation Scheme (FSCS)

- Regulation: FCA UK

- Registration: FCA UK

- Publicly traded: no

- Segregated account: yes

- Guaranteed Stop Loss: yes

- Negative Balance Protection: yes

Is FXOpen UK trusted?

- Information transparency: sufficient

★★★ - Customer service: not so helpful

★★ - FXOpen UK website: highly detailed, updated

★★★★★ - FXOpen UK popularity (by visitor count): average

★★★

How FXOpen UK works

FXOpen UK website: www.fxopen.com/en-gb/ (UK-based)

FXOpen website: www.fxopen.com/en-uk/ (Nevis-based)

Sites will have different trading conditions & account types.

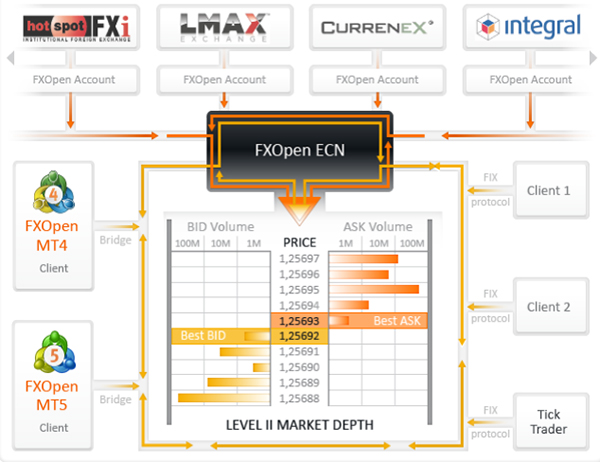

True ECN Model

All accounts at FXOpen UK are ECN or STP accounts and use the ECN model. The ECN model gives traders access to the Interbank market where the counterparty to your trade is a liquidity provider such as a bank, fund, or another trader. There is no intervention from FXOpen, no dealing desk and no requotes.

ECN accounts are suitable for all types of trading due to its fast execution and deep liquidity. This is especially useful for scalping, high frequency and automated trading. The ECN Model uses Market Execution, which means that your order will be filled in the interbank market but the execution price may differ from the price you requested upon placing the order.

https://www.fxopen.com/en-gb/why-us/

14.PRICES

14.1 We set the Price for all Margined Trades at our complete discretion.

12.CONFLICTS OF INTEREST AND MATERIAL INTERESTS

We, or our Associates, may have an interest or relationship which conflicts with your interest or our duties to you.

42.1FXOL will periodically hedge its liability to you by opening similar positions with other institutions.

14.1 We set the Price for all Margined Trades at our complete discretion.

12.CONFLICTS OF INTEREST AND MATERIAL INTERESTS

We, or our Associates, may have an interest or relationship which conflicts with your interest or our duties to you.

42.1FXOL will periodically hedge its liability to you by opening similar positions with other institutions.

https://www.fxopen.com/en-gb/policy/ (FXOL_Terms_v1.2.pdf )

3.1 Execution Venues

The Company has elected to appoint FXOpen LP Limitedfxopenprime.com as it’s ECN environment provider to whom all orders will be transmitted for execution. The Company has selected this ECN environment based on the technology they use to obtain the best possible outcome for your order. The aggregator derives its prices for Spot FX from multiple liquidity providers in the wholesale market.

Although the Company will transmit Client orders for execution, contractually the Company remains the sole counterparty to the Clients’ trades and any execution of orders is done in the Company’s name, therefore the Company is the sole Execution Venue for the execution of Client orders.

The Company has elected to appoint FXOpen LP Limitedfxopenprime.com as it’s ECN environment provider to whom all orders will be transmitted for execution. The Company has selected this ECN environment based on the technology they use to obtain the best possible outcome for your order. The aggregator derives its prices for Spot FX from multiple liquidity providers in the wholesale market.

Although the Company will transmit Client orders for execution, contractually the Company remains the sole counterparty to the Clients’ trades and any execution of orders is done in the Company’s name, therefore the Company is the sole Execution Venue for the execution of Client orders.

Trade and Order Execution Policy v1.1.pdf

8.1 When you carry out Margined Trades, FXOL will act as principal and not as agent on your behalf in all non-ECN Transactions.

https://my.fxopen.co.uk/Download?name=FXOL_Terms_v1.3.pdf

Add new comment...